Home / Gifts / Rare Charity Donations

Couldn't load pickup availability

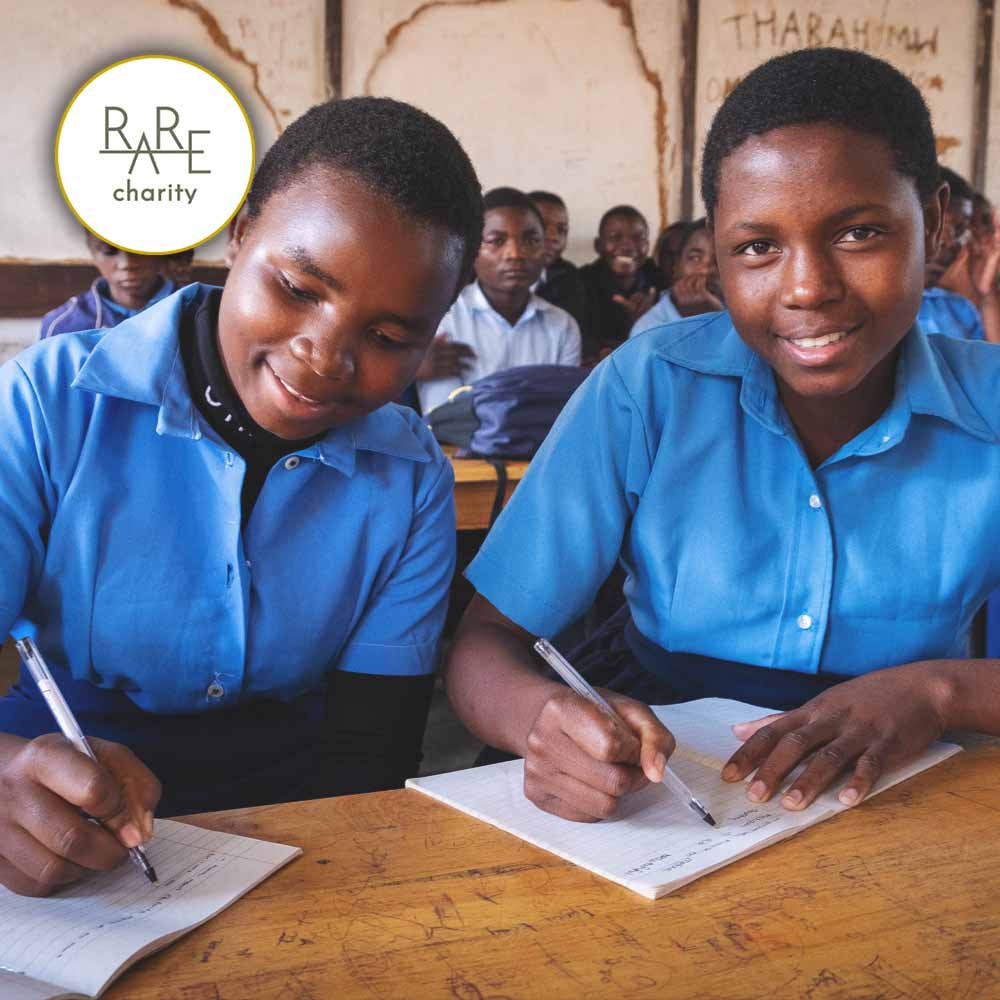

Support the communities who grow and craft your tea.

A donation to Rare Charity contributes towards the expansion of the scholarship programme. Many talented young people are determined to continue their education but lack the means to do so. We want to reach and support more exceptional scholars, giving them the opportunity to transform their lives and their communities.

£75 could pay for a month's full boarding school scholarship for a girl in Malawi. This provides vital support with accommodation, meals, materials and healthcare, to a student who could not otherwise continue their education.

Rare Charity's running costs are largely met by Rare Tea Company. Beyond the donation we make from your purchases, you can donate directly by adding these products to your basket.

All our donation products include a PDF printout that you can include in a card or present (it will be emailed to you after checking out). You can checkout with any currency for these donations, so please don't worry if you're shopping in €/$/¥. These are digital products and do not incur shipping charges.

Share

How Rare Charity began

At Rare Tea we believe in supporting the three pillars of sustainability: environmental, economic, and social. Our founder and CEO Henrietta Lovell set up the wholly independent Rare Charity in an attempt to answer some of the social needs of the tea communities we work with.

She asked the people on our partner farms how we could best support them, and they gave a clear answer: educational opportunities for their children. This could allow young people to build long term, sustainable development for themselves, their families and their communities.

Rare Tea invests a direct percentage of revenue (not profit) into Rare Charity.

Rare Charity invests in full educational scholarships where opportunities are rare, but talent is not.

Rare Charity began in Malawi where we saw the greatest need.

Rare Charity's tertiary educational scholarship programme enables individuals to become qualified professionals. Over half these scholarships will always be set aside for young women.

In 2020, Rare Charity invested in girls at an earlier stage. Once schools reopened after COVID closures, it was clear that many girls had not returned and reports agreed on a steep rise in child marriages. Rare Charity invested in secondary scholarships to enable girls to choose education, to complete their secondary schooling and to fulfil their ambitions.

We know the programmes are working. The focus is tight and direct. By working specifically in tea communities we know personally, we can see a very real and positive impact. Rare Charity scholars have graduated and invested their skills as doctors, teachers, midwives and business leaders.

During 2022, Rare Charity expanded its work into Nepal.